FTB is sending notices to taxpayers about our corrections to mistakes found on 2022 tax returns. Some notices may state a balance due with a due date for payment. Taxpayers affected by the 2022-23 California winter storms who receive such a notice still qualify for an extension to pay taxes until November 16, 2023. View our emergency tax relief page for more information.

You receive this notice when we correct one or more mistakes on your tax return. The information is only for the tax year printed at the top of the notice.

Enter the code found at the end of each paragraph from your notice: You can use the pipe character (|) to search for more than one code at a time.

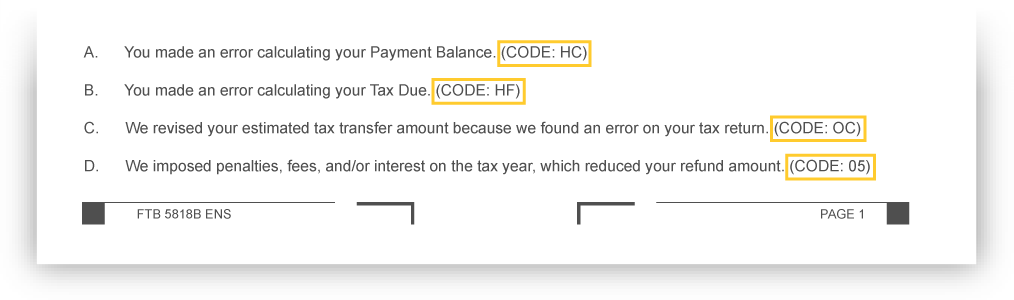

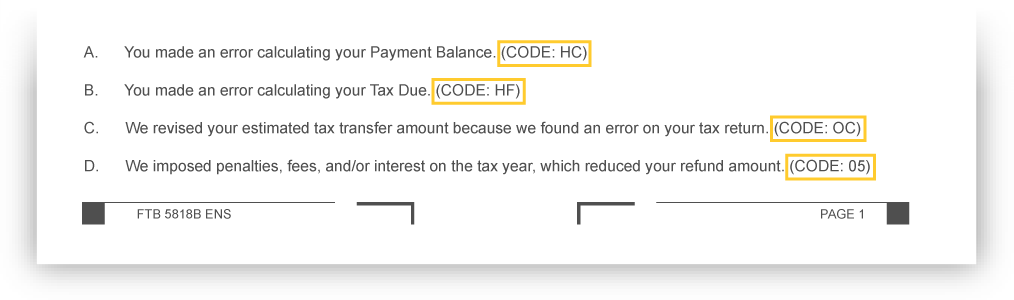

Notice of Tax Return Change letters contain one or more alphanumerical code at the bottom of the page. An example is provided below.

| Code | Related Paragraph | What to Do |

|---|---|---|

| 01 | We reduced the amount of credit you asked us to transfer to next year’s estimated tax. | See any other code(s) on the notice first for more information. |

| 02 | You owed money to a government agency, which may include us. We applied the overpayment from your return to that liability. | Contact the agency listed on your notice. |

| 03 | The overpayment on your tax return is not enough to cover all contributions you requested. If you chose more than one contribution fund, we divided the amount among the funds. | Gather: Your return. Review: Your refund and contribution amounts. See any other code(s) on the notice first for more information. |

| 04 | We applied the overpayment on your tax return to a balance due on your account. | You do not need to do anything extra before contacting us. |

| 05 | We imposed penalties, fees, and/or interest on the tax year, which reduced your refund amount. | You do not need to do anything extra before contacting us. |

| 06 | We found an error on your tax return in your calculation of total contributions. As a result, we revised your contribution and refund amounts. | Gather: Your return. Review: The math of your contribution amounts and your refund. |

| 08 | We did not process the contribution you requested because we no longer administer the fund. | If you want to contribute to this fund, contact the fund directly. |

| 09 | We disallowed the contribution you requested because you have no credit available for the tax year. | If you want to contribute to this fund, contact the fund directly. |

| 10 | We revised your contribution to the California Seniors Special Fund for one of the following reasons: (a) The contribution you designated was more than the amount allowed for your senior exemption. (b) The amount of your available credit you had was not enough to allow the contribution. | If you want to contribute to this fund, contact the fund directly. |

| 11 | We disallowed the contribution you requested. Unless you have filed a timely claim, we cannot allow a credit or refund after the later of the following dates: (a) Four years from the original due date of the return. (b) Four years from the date you filed the return, if filed within the extension period. (c) One year from the date you overpaid your income taxes. | If you want to contribute to this fund, contact the fund directly. |

| 12 | We imposed penalties, fees, and/or interest, which revised your balance due. | Gather: W-2s, tax return, related tax documents, proof of payment, if applicable (e.g. canceled check, transaction number, etc.) |

| 14 | We disallowed your direct deposit refund request because we cannot deposit more than two refunds into the same bank account. | Gather: W-2s, tax return, related tax documents, proof of payment, if applicable (e.g. canceled check, transaction number, etc.) |

| 15 | We disallowed your direct deposit refund request because we changed your refund amount. | Gather: W-2s, tax return, related tax documents, proof of payment, if applicable (e.g. canceled check, transaction number, etc.) |

| 16 | We disallowed your direct deposit refund request because the account information needed additional validation. We converted your direct deposit request to a paper check to ensure a timely refund. | Gather: W-2s, tax return, related tax documents, proof of payment, if applicable (e.g. canceled check, transaction number, etc.) |

| 17 | We cannot transfer to the California Department of Tax and Fee Administration the Use Tax amount reported on your income tax return because you have no credit available. To pay Use Tax, please mail a copy of this notice with a check made payable to “California Department of Tax and Fee Administration” to CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION, PO BOX 942879, SACRAMENTO, CA 94279-7073. For assistance with Use Tax questions, please telephone the California Department of Tax and Fee Administration’s Information Center at 800-400-7115 or go to cdtfa.ca.gov. |

Gather: Your Form 3514, California Earned Income Tax Credit and Form 540 or 540 NR tax return to confirm your entries and calculations are correct.

Contact the Filing Compliance Bureau:

Phone: 916-845-7088

We revised or disallowed your Earned Income Tax Credit because you did not substantiate your business activity.

For each source of self-employment that you and your spouse/RDP (if filing jointly) reported, provide the following from your federal income tax return (if applicable):

� Schedule C, Profit or Loss from Business

� Schedule C-EZ, Net Profit from Business

� Schedule F, Profit or Loss from Farming

� Schedule SE, Self-Employment Tax

In addition, you must provide copies of the following supporting documentation to verify self-employment:

� A profit and loss statement or schedule used to determine the business income and expenses reported on your tax

return, along with:

� Business bank statements and credit card statements supporting your business income (covering at least 2 months)

� Any certification, license, permit or registration required for your business (taxicab, cosmetology, food service,

contractor, vendor, etc.)

� Any federal Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc.

Contact or submit documents to the Filing Compliance Bureau:

Phone: 916-845-7088

Fax: 916-845-9351

Mail: Franchise Tax Board MS 151

PO Box 1468

Sacramento, CA 95812-1462

We revised or disallowed your Earned Income Tax Credit because you did not substantiate your business activity and the wages claimed.

Gather: W-2s, tax return, related tax documents, proof of payment, if applicable (e.g. canceled check, transaction number, etc.)

For each source of self-employment that you and your spouse/RDP (if filing jointly) reported, provide the following

copies from your federal income tax return� (if applicable):

� Schedule C, Profit or Loss from Business

� Schedule C-EZ, Net Profit from Business

� Schedule F, Profit or Loss from Farming

� Schedule SE, Self-Employment Tax

In addition, you must provide copies of the following supporting documentation to verify self-employment:

� A profit and loss statement or schedule used to determine the business income and expenses reported on your tax

return, along with:

� Business bank statements and credit card statements supporting your business income (covering at least 2 months)

� Any certification, license, permit or registration required for your business (taxicab, cosmetology, food service,

contractor, vendor, etc.)

� Any federal Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc.

Contact or submit documents to the Filing Compliance Bureau:

Phone: 916-845-7088

Fax: 916-845-9351

Mail: Franchise Tax Board MS 151

PO Box 1468

Sacramento, CA 95812-1462

If you feel this is an error, please gather the following:

Social security card(s) and birth certificate(s) for your qualifying child or children, and proof of residence.

Contact or submit copies to the Filing Compliance Bureau:

Phone: 916-845-7088

Fax: 916-845-9351

Mail: Franchise Tax Board MS 151

PO Box 1468

Sacramento, CA 95812-1462

Gather: Social Security card/ITIN documents.

Contact and submit copies to the Filing Compliance Bureau:

Phone: 916-845-7088

Fax: 916-845-9351

Mail: Franchise Tax Board MS 151

PO Box 1468

Sacramento, CA 95812-1462

We revised or disallowed your Young Child Tax Credit based on the earned income reported on your tax return or provided by your employer or client.

Gather: W-2s, tax return, related tax documents, proof of payment, if applicable (e.g. canceled check, transaction number, etc.)

For each source of self-employment that you and your spouse/RDP (if filing jointly) reported, provide the following from your federal income tax return (if applicable):

� Schedule C, Profit or Loss from Business

� Schedule C-EZ, Net Profit from Business

� Schedule F, Profit or Loss from Farming

� Schedule SE, Self-Employment Tax

In addition, you must provide copies of the following supporting documentation to verify self-employment:

� A profit and loss statement or schedule used to determine the business income and expenses reported on your tax

return, along with:

� Business bank statements and credit card statements supporting your business income (covering at least 2 months)

� Any certification, license, permit or registration required for your business (taxicab, cosmetology, food service,

contractor, vendor, etc.)

� Any federal Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc.

Contact or submit documents to the Filing Compliance Bureau:

Phone: 916-845-7088

Fax: 916-845-9351

Mail: Franchise Tax Board MS 151

PO Box 1468

Sacramento, CA 95812-1462

Gather: Your Form 3514, California Earned Income Tax Credit and your Form 540 or 540NR tax return to confirm your entries and calculations are correct.

Contact the Filing Compliance Bureau:

Phone: 916-845-7088

Gather: Your Form 3514, California Earned Income Tax Credit and your Form 540 or 540NR tax return to confirm your entries and calculations are correct.

Contact the Filing Compliance Bureau:

Phone: 916-845-7088

Gather: Proof of your earned income (W-2, W-2C, 1099 forms) and final year-to-date pay stub(s).

Contact or submit documents to the Filing Compliance Bureau:

Phone: 916-845-7088

Fax: 916-845-9351

Mail: Franchise Tax Board MS 151

PO Box 1468

Sacramento, CA 95812-1462

Gather: Your Form 3514, California Earned Income Tax Credit and your Form 540 or 540NR tax return to confirm your entries and calculations are correct.

Contact the Filing Compliance Bureau:

Phone: 916-845-7088

If you feel this is an error, please contact the Filing Compliance Bureau:

Mail: State of California

Filing Compliance Bureau MS F151

Franchise Tax Board

PO Box 1468

Sacramento CA 95812-1468

If you feel this is an error, please contact the Filing Compliance Bureau:

Mail: State of California

Filing Compliance Bureau MS F151

Franchise Tax Board

PO Box 1468

Sacramento CA 95812-1468